How To Turn ESG Reporting Into Your Best Asset

ESG Reporting and Your Business

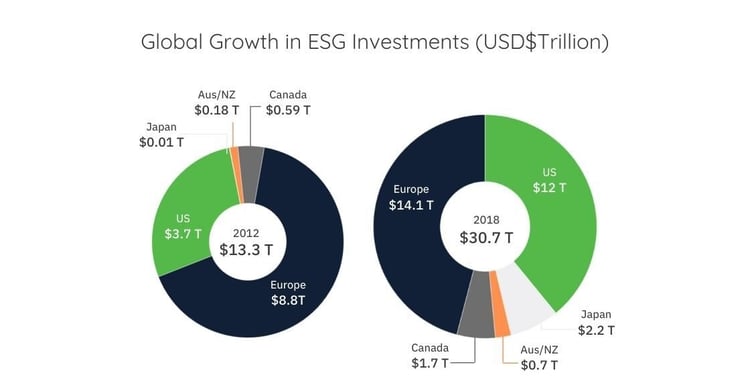

Historically, a company’s success has been determined with financial performance indicators, like profit and return on equity. Recently this has been changing. Environmental, Social, and Governance (ESG) factors now play a much larger role in this process.

A survey by Ernst & Young (EY) of 320 senior decision-makers found that 92% believed ESG issues have a quantifiable impact on company success [1]. Additionally, there is mounting evidence that links ESG issues directly to short- and long-term financial performance.

You may be asking yourself, if ESG factors are so important why don’t all companies implement ESG reporting into their business? The short answer is it can be complicated, requires continued effort and yearly improvements, and there is a lot of documentation and data that has to be reviewed to create accurate and transparent ESG metrics.

What Is ESG and ESG Reporting?

ESG stands for Environmental, Social, and Governance. These are non-financial indicators that provide performance criteria on how your business is doing in regards to its social responsibility. It is made up of three categories:

1. Environmental Criteria

This looks at how your company impacts the environment. Common environmental criteria include energy and resource use, waste discharge, and carbon emissions.

2. Social Criteria

This considers the relationships and reputation your company has with the people and institutions in the communities where it does business. Common social criteria include labor relations, diversity, and safety.

3. Governance Criteria

This examines the internal systems a company uses to govern itself, make decisions, and meet the needs of external stakeholders. Common governance criteria include executive pay, corruption, and business ethics.

Each of these broad categories is further composed of multiple individual indicators. Depending on which ESG reporting method is used, the number of total indicators ranges from 14 to 120 [3].

ESG reporting is the process of turning these three categories and indicators into a single number that is made available to company stakeholders. The goal of reporting is to increase company transparency and provide a method for stakeholders to easily understand how well your company is doing in different ESG categories.

The Benefits of ESG Reporting

ESG reporting makes a wealth of information available. It includes the good and the bad on how your company impacts the world. This goes beyond how the company is doing financially by showing the ethics behind its operations.

Between 2011 and 2018, the number of S&P 500 companies publishing ESG reports went from 20% to 86%. This change alone indicates how important ESG reporting is. Transparency has the ability to create consumer trust and develop positive relationships with investors. Companies that don’t utilize the power of ESG risk losing the trust of investors and losing their competitive advantage to those that do [4].

Want to learn more about how your company can leverage ESG reporting? Source Intelligence can help your firm create customized document review with data collection software to streamline your ESG reporting systems.